Standard Mileage Deduction 2024

Standard Mileage Deduction 2024. This rate will apply beginning on january 1,. On december 14, 2023, the internal revenue service (irs) issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business,.

In 2023, the irs rate for the mileage tax deduction was 65.5 cents per mile. As we approach the new year, understanding the changes in the 2024.

The New Irs Mileage Rates For 2024 Are 67 Cents Per Mile For Business Purposes (Up From 65.5 Cents Per Mile In 2023), 21 Cents Per Mile For Medical Or Moving Purposes And.

This amount increases to 67 cents per mile for 2024.

The Standard Deduction Gets Adjusted Regularly For Inflation.

The portion of the business standard mileage rate treated as depreciation is 27 cents per mile for 2020, 26 cents per mile for 2021 and 2022, 28 cents per mile for 2023, and.

For 2024, The Deduction Is Worth:

Images References :

Source: www.taxslayer.com

Source: www.taxslayer.com

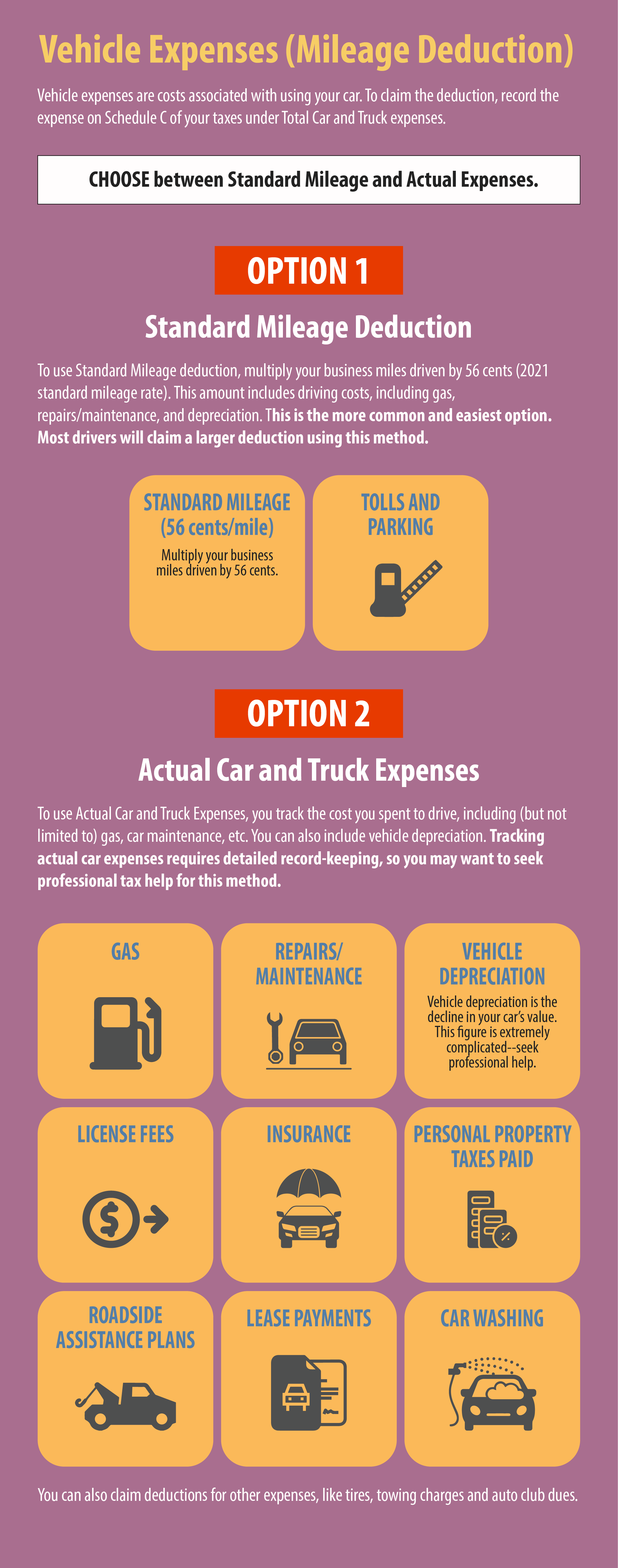

A Quick & Easy Guide to Business Mileage Deduction Methods, The portion of the business standard mileage rate treated as depreciation is 27 cents per mile for 2020, 26 cents per mile for 2021 and 2022, 28 cents per mile for 2023, and. 1, 2024, the standard mileage rates for the use of a car, van, pickup or panel truck will be:

Source: finaqlinell.pages.dev

Source: finaqlinell.pages.dev

What Is The Standard Deduction For 2024 Grata Brittaney, The portion of the business standard mileage rate treated as depreciation is 27 cents per mile for 2020, 26 cents per mile for 2021 and 2022, 28 cents per mile for 2023, and. 1, 2024, the standard mileage rates for the use of a car, van, pickup or panel truck will be:

Source: www.taxoutreach.org

Source: www.taxoutreach.org

How to Claim the Standard Mileage Deduction Get It Back, The standard deduction gets adjusted regularly for inflation. For medical purposes is 21 cents per mile, and for charitable work is 14 cents per mile.

Source: www.taxoutreach.org

Source: www.taxoutreach.org

How to Claim the Standard Mileage Deduction Get It Back, Washington — the internal revenue service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. 1, 2024, the standard mileage rates for the use of a car, van, pickup or panel truck will be:

Source: turbotax.intuit.com

Source: turbotax.intuit.com

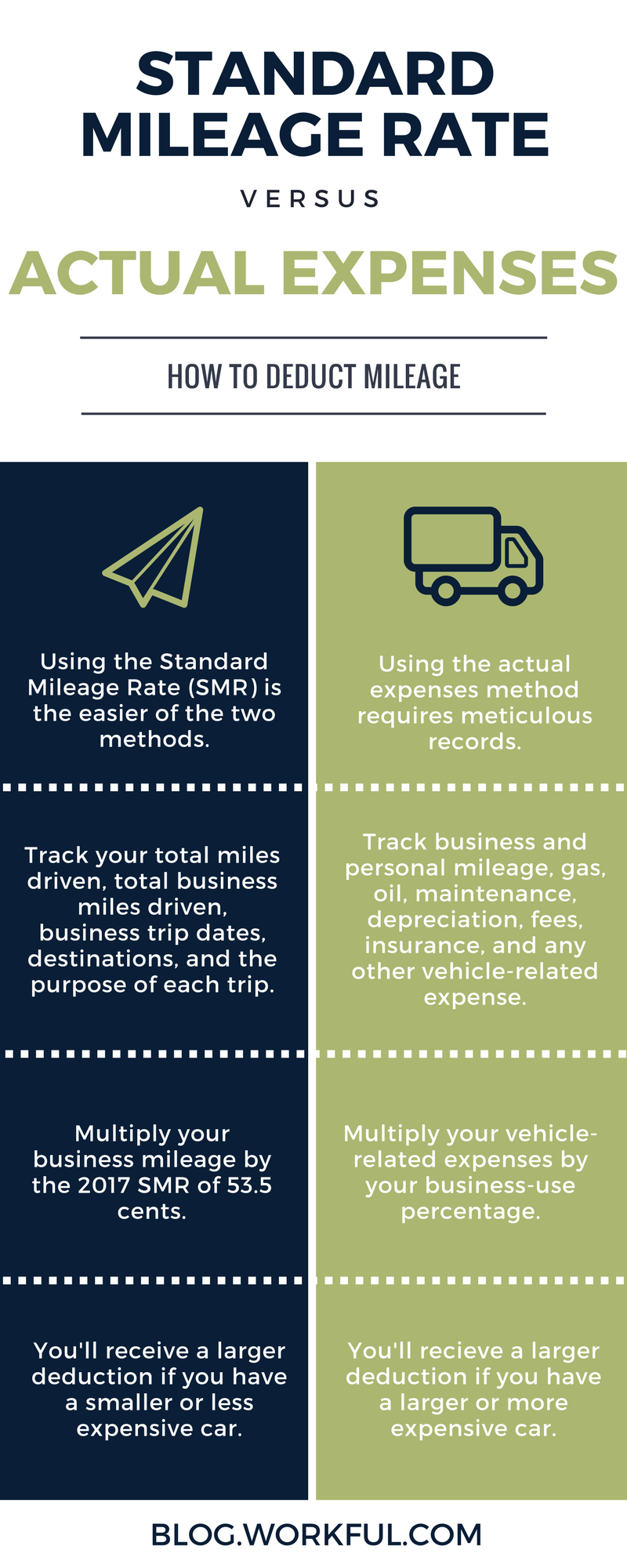

Standard Mileage vs. Actual Expenses Getting the Biggest Tax Deduction, Car expenses and use of the standard mileage. Should you use the standard mileage or actual expenses.

Source: workful.com

Source: workful.com

Mileage Deduction Standard Mileage Rate Workful Blog, The irs has announced its 2024 standard mileage rates. This rate will apply beginning on january 1,.

Source: www.marketplacehomes.com

Source: www.marketplacehomes.com

New Standard Deductions for 2024 Taxes Marketplace Homes Press Release, This amount increases to 67 cents per mile for 2024. For 2024, the deduction is worth:

Source: therideshareguy.com

Source: therideshareguy.com

Standard Mileage vs Actual Vehicle Expenses for Uber Drivers, This notice provides the optional 2024 standard mileage rates for taxpayers to. Taxpayers encouraged to try innovative new option before april 15 deadline.

Source: www.youtube.com

Source: www.youtube.com

Deducting Vehicle Expenses The Standard Mileage Rate YouTube, This was a three cent increase from the second half of. Use in computing the deductible costs of operating an automobile for business,.

Source: centifyco.com

Source: centifyco.com

New Standard Mileage Deduction Rates for 2023 CENTIFY™, On the other hand, it can be a mileage reimbursement when. Mileage tax deduction rates for 2023.

For 2023, The Irs' Standard Mileage Rates Are $0.655 Per Mile For Business, $0.22 Per Mile For Medical Or Moving, And $0.14 Per Mile For Charity.

Car expenses and use of the standard mileage.

The Irs Has Announced Its 2024 Standard Mileage Rates.

Learn the difference between standard mileage vs.